How to trade using currency strength

Currency strength can be used to trade a wide range of market conditions, including trend, counter trend and range, but the easiest for the majority of trading strategies to trade will be with the trend. When trading trending markets you should buy a strong currency (>+3) against a weak currency (<-3). Good examples to look at for this will be pairs listed under possible trending buys or sells on the list above.

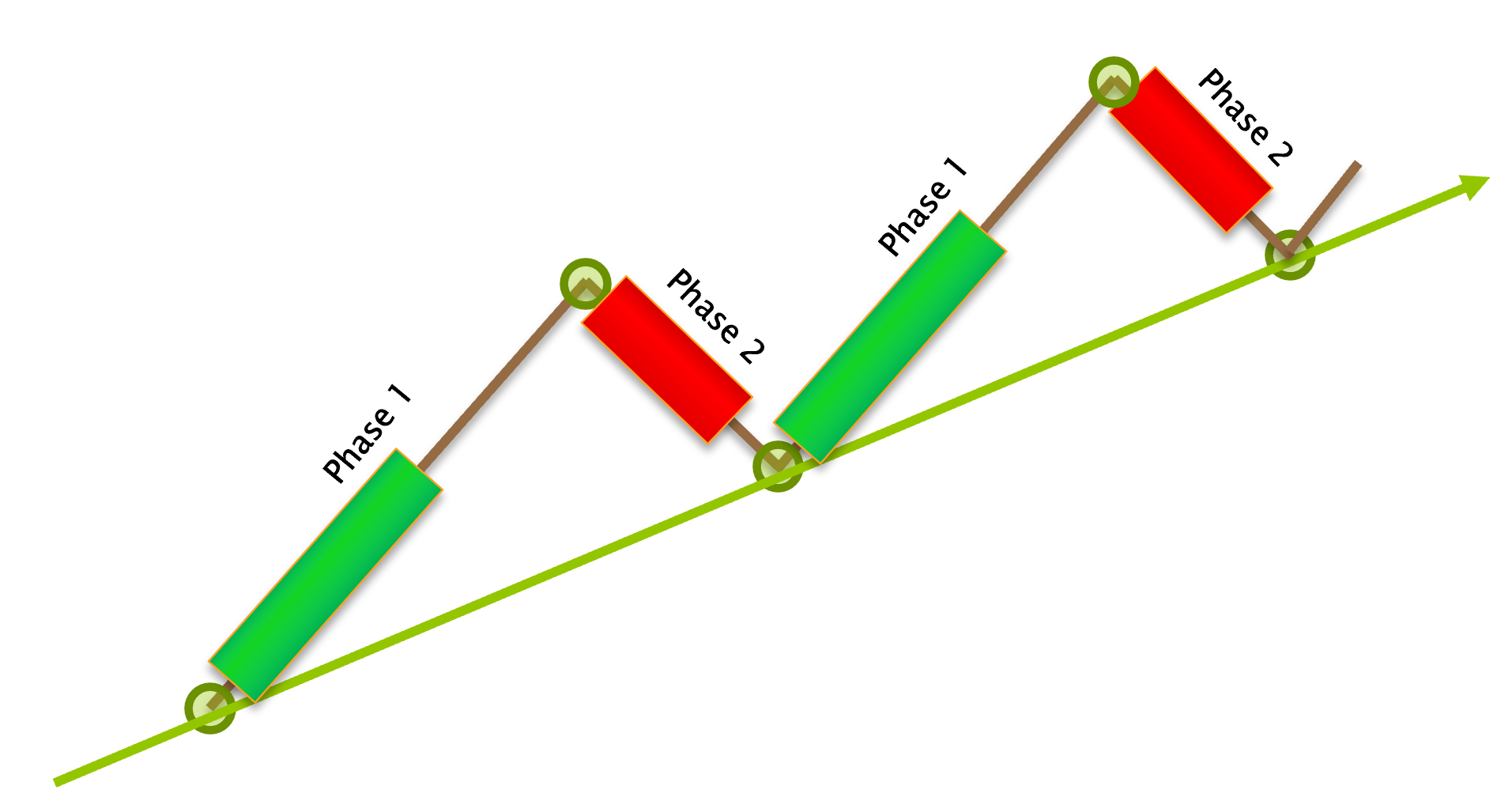

When you've identified a strong/weak pair, you then need to identify where price is within that trend before entering. Ideally, at the time of entering a trade, you want price to be within either of the green zones illustrated in the uptrend example below. This will mean you are trading in the direction of the trend, and have enough room left in that move to reach a profit target.

If you wish to trade counter trend, you should look to sell strong currencies against weak currencies, expecting their roles to reverse, with the strong becoming weak and the weak stronger. Good examples to look at for this will be pairs listed under possible counter trend buys or sells on the list above. Again, you should also study their respective charts very closely before entering any trade and you ideally want pirce to be entering either of the red zones illustrated on the example below. These zones are where the trend has become exhausted and a counter trend move is more likely.

The markets listed above are based on the pairings of the

strongest and

weakest currencies from

our

currency strength meter as we start the new trading week. The scores will change through the week and these changes can be found using

our live indicator, which will signal these changes

in real time and also across all time frames. Please use the strong and weak corrency pairs in combination with your own trading strategy to ensure you can find safe and efficient entries into these markets.

Please use your own judgement before entering any trades.