Where next for Gold in 2021

Where do you see Gold going from here? Have you been a patient buyer recently or a happy seller so far in 2021? The weakness in Gold so far this year is something that seems to

have caught many by surprise, but it's something I have been talking about on my weekly webinars since before Christmas, so it needn't have been a surprise. I'm by no means bearish on Gold, in fact, I'm planning to be a buyer

but it's just a matter of timing, and as I've been saying for the past few months, the timing just isn't right, yet.

There are a number of factors for its weakness but ultimately the

conditions are just not in place for a major rally, but that will change later in the year. One of the factors that have allowed me to project Gold's path lower, has been my ability to analyse

Gold's seasonal patterns and in particular its Post US-election pattern.

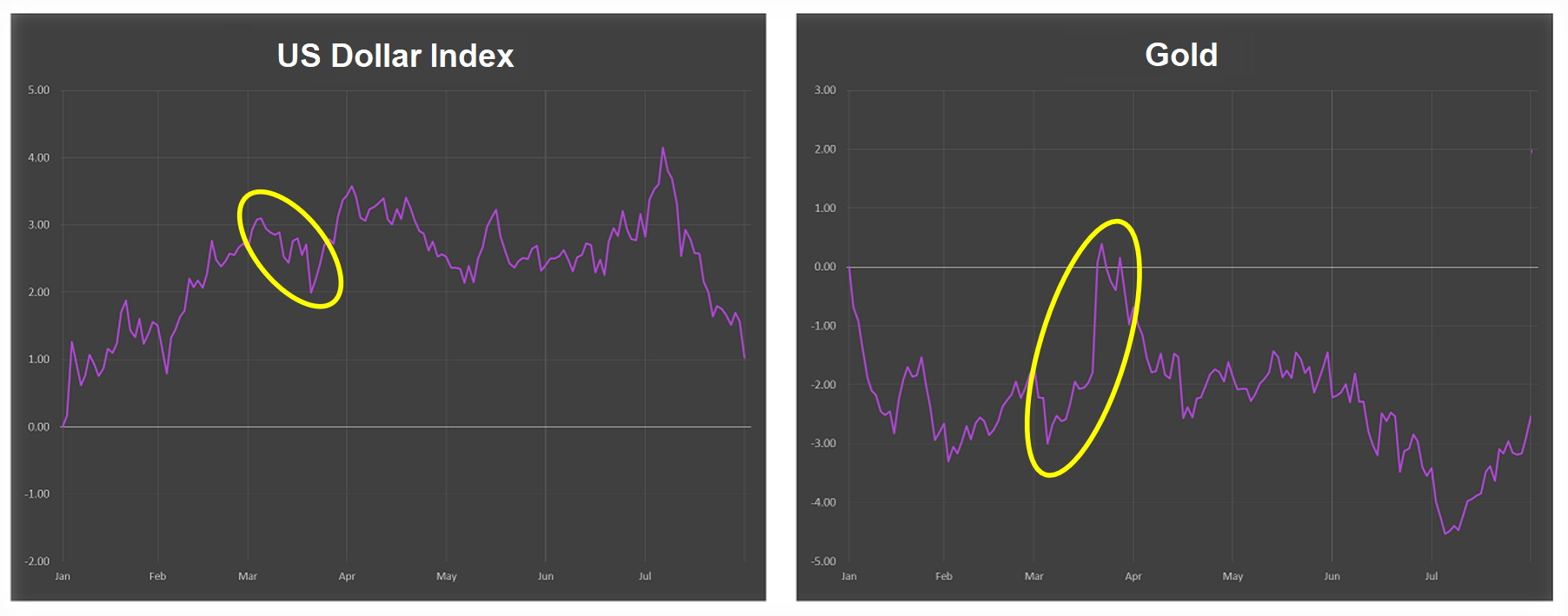

You can see in the chart below (Gold on right), that Gold typically performs badly in the

early part of Post-election years, while the US Dollar typically performs well.

looking at both charts a little closer, we can see that the Dollar typically starts Post-election years well, and continues its uptrend through February. It then retraces in its uptrend from around March 3rd to March 20th, before continuing on its uptrend to around April 2nd. If we compare that to the actual price movement of the Dollar, we can see that it has performed very well in January before a retracement and rally late in February to a top on March 9th. We can take from this that we are following the expected pattern, but a few days later than expected, something that is very common when a market's seasonal pattern is going against its trend.

Looking at Gold's Post-election pattern, it shows weakness at the beginning of the year, which eases before a rally from March 3rd to March 22nd, where the pattern is then to see further weakness. Comparing this to its recent price movement, Gold was very weak through January as expected but has continued this weakness, again common for a market when its pattern agrees with its current trend. Price did bottom on March 8th, a few days late, and is now in the area of an expected top as we head into April.

Combining the patterns above with what I can see happening in these markets through the Commitments of traders, has allowed me to be positioned in the right way so far this year. Looking ahead, I am expecting the Dollar to resume its uptrend until the end of the month, potentially up to the 94 area. While I will be looking for sellers to re-enter the Gold market around 1760 and take the metal back towards its recent lows.

There is nothing complicated about how I read markets or project their movement, but it does rely on my ability to do 4 very important things:

- Correctly analyse seasonal patterns.

- Determine which seasonal pattern we are following, (if any).

- Understand how market structure will impact the seasonal pattern.

- Project a seasonal pattern onto my charts so I can anticipate entries.

It would have been very easy to simply look at a basic seasonal pattern for Gold, and expect it to rally through January and February, but this wouldn't be using seasonality correctly.

Seasonality is a very simple concept but sadly one that is also widely misunderstood and traders get confused when 'it doesn't work'. It's not just a case of looking at one line on a chart and expecting a market to go up or down, there is a little more to it than that. When it is understood, however, seasonality can give you a massive insight into a market's future price movement, and that is exactly why I have been using it for the past 13 years.

|By Ray Gilmour|