No love for USD, but AUD shines

|25th March 2015|

Could the relentless US dollar train finally be running out of steam? I wrote a few weeks ago

“Why it’s time to buy when your mother says sell” that the end of the current down trend in Euro is closer than most think and the signs have been there in recent weeks that the same could be said for the uptrend in USD.

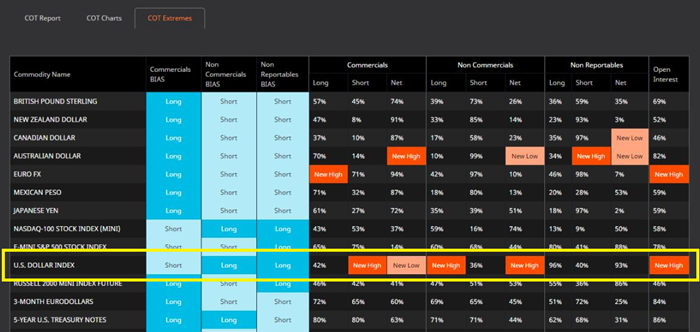

There is a simple fact in trading and that is all trends will end, knowing exactly when it the hard part. One major warning sign I use to help me determine the end of a trend is market extremes. A trend will continue as long as new money keeps entering to push it in the same direction, once the new money dries up, the trend falters and often collapses. A symptom of this is a market that sets extremes in either the number of buyers or sellers. In the case of USD (Figure 1.1 below) in the last 2 weeks the Non-commercial ‘trend followers’ have reached a new all-time high in the number of long ‘buying’ positions held. Contrast that with the new all-time high in short ‘selling’ positions held by the Commercials ‘trend enders’ and it was only a matter of time before this imbalance caused a reaction.

Figure 1.1. US Dollar extreme readings in Commercial and Non-commercial traders

Another warning sign can be seen via market correlations. As is often the case, one markets demise is another’s time to shine. While traders have been buying as many US dollars as they can, they have also been selling as many Australian dollars as they can, but what happens when you reach the extremes I referred to above? Well those same traders that have been endlessly buying US dollars will quickly liquidate their positions and seek to buy something else. In figure 1.2 below we see that just a week following the extremes in the US dollar there has been a major flow (317% increase, green line) of new Non-commercial buyers into the Australian dollar at the same time as the Commercials reach very bullish levels. The fact that the Australian dollar seasonally performs very well through April and May and the US dollar doesn’t, simply allowed me to prepare for the warning signs I am now seeing.

Figure 1.2. 317% increase in Non-commercial long positions in Australian dollar

The media will have you believe that the market has turned because of something the Fed said last week or anyone else for that matter, but the warning signs were there before anything was said. Most news will only send the market in the direction it was going to go anyway.

By Ray Gilmour